When managing a project, you’ll inevitably face risks that can impact your project’s budget and schedule, and you need effective tools to assess these risks qualitatively and quantitatively to make smart decisions.

Expected monetary value (EMV) analysis is one such statistical technique used in risk management to predict the likely financial outcomes of your project based on possible scenarios.

In this post, we’ll explore what expected monetary value entails and how to calculate it using a simple formula that accounts for probability and impact.

You’ll learn when EMV can help with your project’s decision-making and how it fits into your broader quantitative risk analysis approach.

For PMP certification aspirants, this is an important concept to understand as it is an integral part of project risk management and you can expect questions on it.

What is Expected Monetary Value in Project Management?

Expected monetary value (EMV) is a statistical concept used in project risk management that lets you analyze the probability and financial impact of potential risks to your project.

EMV calculates the average expected value over a range of possible outcomes where each outcome has a probability of occurring. Positive outcomes add value, while negative outcomes incur a cost.

By multiplying the probability and impact of each outcome, you can quantify risks in monetary values. Then adding up the EMV for all possible outcomes gives you an expected value for the total risk position of your project.

This statistical forecast helps you as a project manager or project sponsor make better-informed decisions under uncertainty and is a key technique used in quantitative risk analysis.

Expected Monetary Value Formula

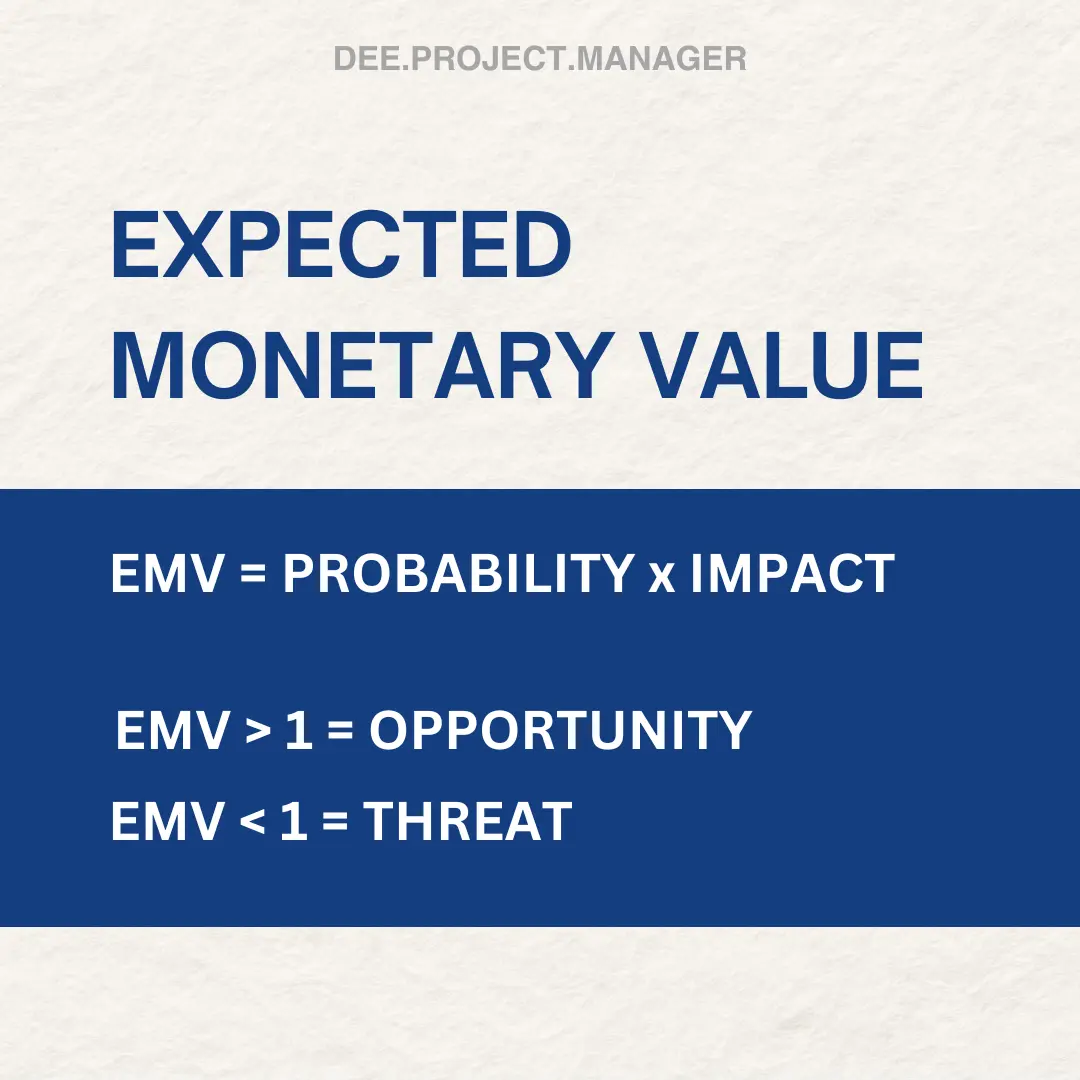

The expected monetary value formula as earlier iterated is:

EMV = Probability x Impact

Where:

- Probability is the chance of the risk occurring, expressed as a percentage between 0-100%.

- Impact is the financial effect if the risk occurs, which could be positive or negative.

While a positive EMV represents opportunities, a negative one represents threats. The total EMV provides you with an expected monetary value of the overall risk position of the project or activity.

How to Calculate Expected Monetary Value

Calculating expected monetary value helps quantify risks and opportunities to support data-driven decisions for your project.

Follow these steps:

1. Identify and Document Project Risks

Hold brainstorming sessions to identify risks that may affect your project’s budget or schedule. Also, review risk registers from past projects.

2. Estimate probability

Determine the probability of each risk occurring as a percentage from 0-100%.

- 0% – Will not happen

- 50% – Equally likely to happen or not

- 100% – Will definitely happen

To estimate, you can use data from past projects, expert judgment, and decision tree analysis.

3. Estimate impact

Determine the potential financial impact of each risk in dollar terms if it does occur.

- Positive value – Opportunity

- Negative value – Threat

Consider the cost to resolve the risk or potential benefits it may bring.

4. Calculate EMV

For each risk, multiply the probability and impact to calculate its EMV.

EMV = Probability x Impact

5. Determine overall EMV

Add together the EMV values for all identified risks to get the total expected monetary value.

6. Use EMV to support decisions

The total EMV helps to determine the required contingency reserve and also provides data to decide whether to pursue opportunities or mitigate threats based on their expected values.

Purpose of Expected Monetary Value Analysis in Project Management

Expected monetary value analysis serves several key purposes in project risk management including:

- It provides a statistical forecast of the cumulative effect of project risks in monetary value terms which gives you data to make informed decisions under uncertainty.

- Calculating EMV requires estimating the probability and impact of each risk. This process helps to identify and understand threats and opportunities.

- The total EMV indicates whether the overall risk position of a project is positive or negative.

- EMV supports better project budgeting. The total EMV helps determine the contingency reserve amount required to cover expected losses from project risks.

- Comparing EMV for different project options supports decision-making. The option with the highest positive EMV represents the best opportunity.

- Tracking EMV over time provides trends on whether the overall risk outlook for the project is improving or worsening.

- EMV helps prioritize which risks to actively manage based on their expected values. Focus is placed on mitigating major threats and pursuing large opportunities.

Benefits of Expected Monetary Value Analysis

Expected monetary value (EMV) analysis provides several key benefits for project risk management.

Here are some of its benefits:

Quantifies Risks in Monetary Values

EMV analysis assigns a monetary value to each risk based on its probability and impact thereby providing an objective measure to compare and prioritize risks.

Determines Contingency Reserves

The total EMV indicates the extra funds required to cover expected losses from project risks and helps determine the contingency reserve amount to budget for effectively.

Supports Decision-Making

EMV analysis provides data to decide whether to pursue opportunities or mitigate threats depending on their expected values. It also aids in choosing between project alternatives.

Identifies Major Risks

Calculating EMV requires analyzing each risk’s probability and impact which helps identify major threats to proactively manage and opportunities to pursue.

Tracks Risk Trends

Monitoring EMV over time shows whether the overall risk outlook for the project is improving or worsening.

Requires Minimal Resources

EMV analysis only requires expert judgment to estimate probability and impact and no expensive simulations or analysis is needed.

Limitations of Expected Monetary Value Analysis

Despite its benefits, expected monetary value analysis has some key limitations to consider:

Subjective Estimates

EMV relies on subjective expert judgment to estimate each risk’s probability and impact. Hence personal bias can affect results.

Interdependent Risks

EMV assumes risks are independent. But risks can be linked, requiring correlated probabilities and impacts.

Data Intensive

For large projects, calculating EMV for every risk becomes data-intensive and complex, and key risks may get overlooked.

Not Comprehensive

As EMV only considers quantified risks, intangible risks like reputation damage are excluded, limiting analysis.

Static View

Risks are dynamic and probabilities and impacts shift constantly. However, EMV only provides a one-time view.

Indirect Costs

EMV only focuses on direct financial impacts, but risks also incur indirect costs like productivity losses.

Resource Requirements

Rigorous EMV analysis requires extensive participation from experts to estimate probabilities and impacts accurately.

Expected Monetary Value Examples

Let’s look at some examples to illustrate how to calculate expected monetary value:

Opportunity Example

A project has a 60% chance of finishing 2 weeks early due to potential process improvements, and this early completion would save $25,000 in resource costs.

- Probability of early completion = 60%

- Impact of early completion = $25,000 savings

EMV = Probability x Impact

= 0.6 x $25,000

= $15,000

This positive EMV represents an opportunity worth pursuing.

Threat Example

A project faces a 20% chance of a key supplier going bankrupt and this would cause a 6-week schedule delay costing $60,000.

• Probability of supplier bankruptcy = 20%

• Impact of delay = $60,000 cost

EMV = Probability x Impact

= 0.2 x -$60,000

= -$12,000

This negative EMV represents a threat to mitigate.

Total EMV Example

A project has identified 3 risks:

• Risk 1: 30% probability, $20,000 positive impact

• Risk 2: 10% probability, $5,000 negative impact

• Risk 3: 50% probability, $15,000 positive impact

Total EMV = Risk 1 EMV + Risk 2 EMV + Risk 3 EMV

= (0.3 x $20,000) + (0.1 x -$5,000) + (0.5 x $15,000)

= $6,000 – $500 + $7,500

= $13,000

The total positive EMV indicates good opportunities associated with the project.

Expected Monetary Value PMP Exam Tips

When preparing for the PMP exam, it is crucial to understand expected monetary value (EMV) as part of the risk management knowledge area.

As per the PMBOK Guide, EMV is a quantitative risk analysis technique used to assess the degree of risk in monetary terms.

EMV is calculated by multiplying the value of each possible outcome by its probability of occurrence and adding up the results.

EMV is particularly relevant in the “Perform Quantitative Risk Analysis” process, where it helps in making decisions under uncertainty by providing a single monetary figure for each risk.

It is also used in the “Plan Risk Responses” process to compare the cost of different strategies and to determine the cost-benefit of risk response actions.

For the exam, ensure you understand how to calculate EMV and interpret its implications on project decisions.

Remember that EMV can be positive or negative and is integral to the cost management aspect of project management.

In a nutshell:

- Memorize the simple EMV formula: EMV = Probability x Impact

- Be able to explain the steps for calculating EMV for project risks

- Recognize examples of opportunities ﴾positive EMV﴿ and threats ﴾negative EMV﴿

- Know that EMV supports quantitative risk analysis and data-driven decisions

- Remember the inputs for EMV are estimates of each risk’s probability and impact

- Understand how EMV helps determine required contingency reserves

- Review EMV calculation examples to master its practical application

- Brush up on EMV’s limitations like subjective estimates and static snapshots

Conclusion

In uncertain project environments, expected monetary value analysis is a must-have technique.

By statistically forecasting the cumulative financial impact of risks based on their probabilities, EMV provides project managers with data-driven insights to make smart decisions.

Despite limitations like subjective inputs, it remains an invaluable quantitative risk analysis method to quantify threats and opportunities.

FAQs

What is the Difference Between Expected Value and Expected Monetary Value?

Expected Value (EV) is a statistical concept that calculates the mean of all possible outcomes.

Expected Monetary Value (EMV) applies EV in monetary terms, specifically in project risk management, to estimate the potential financial impact of risks.

Is a Higher EMV Better?

A higher EMV indicates a potentially greater financial outcome, which may be desirable for positive risks (opportunities) but undesirable for negative risks (threats). The context of the risk determines whether a higher EMV is better.