Deciding on the right pricing model and contract structure is crucial when hiring a contractor for your project.

One feasible option to consider is a cost reimbursement contract, which provides flexibility for projects with evolving requirements.

In this type of agreement, the client reimburses the contractor for permitted costs incurred during delivery.

While cost reimbursement contracts shift financial risk to the client, they provide advantages in some scenarios over fixed price or time and materials models.

In this post, we’ll learn all about cost reimbursement contracts, including their characteristics, types, pros and cons, and when it is ideal for use. We’ll also compare it with other contract types like fixed price, and time and materials.

What is a Cost Reimbursement Contract?

A cost reimbursement contract is a form of agreement where the client reimburses the contractor for permitted expenditures incurred during the execution of the contracted work.

The contractor is paid for all allowed direct and indirect costs related to labor, materials, equipment, travel, and other project expenses.

In addition, the contract includes a negotiated fee paid to the contractor as a profit margin on top of the reimbursed costs. This fee is typically calculated as a percentage of total costs or through a cost-plus formula.

The key aspect is that the client bears the financial risk, fully reimbursing the contractor’s costs as long as they are reasonable and within the contract terms.

There is no guaranteed maximum price, and the total project cost depends directly on the expenses accrued by the contractor when delivering the scope of work.

In this aspect, cost reimbursement contracts differ from fixed price or time and materials contracts where the contractor’s costs are their own responsibility.

Characteristics of Cost Reimbursement Contracts

Cost reimbursement contracts have some defining features that differentiate them from fixed price or Time and Materials contracts.

Here are key characteristics to understand:

- Client Assumes Financial Risk: The client bears most of the financial risk under a cost reimbursement contract. They reimburse contractor costs regardless of any overages or budget issues unless due to negligence.

- Flexible Scope: The project scope can evolve without formal change orders. The contractor is obligated to deliver based on an initial statement of work, but specific requirements can be refined as needs change.

- Open Book Accounting: Cost reimbursement contracts rely on open book accounting – the contractor tracks and shares records of all hours, expenses, and invoices to justify reimbursement requests.

- Negotiated Fee for Profit: The contractor’s profit margin is built in as an agreed-upon fee percentage or structure. It is not tied directly to costs.

- Requires Trust: Trust between client and contractor is crucial since the client reimburses expenses with limited visibility into the contractor’s costs.

- Detailed Invoicing: The contractor must provide well-documented invoices outlining all reimbursable costs for each billing period.

- Contract Changes: Changes can be informal based on ongoing collaboration rather than formal change orders.

Cost Reimbursement Contract Types

There are several common variations of cost reimbursement contracts. The main types include:

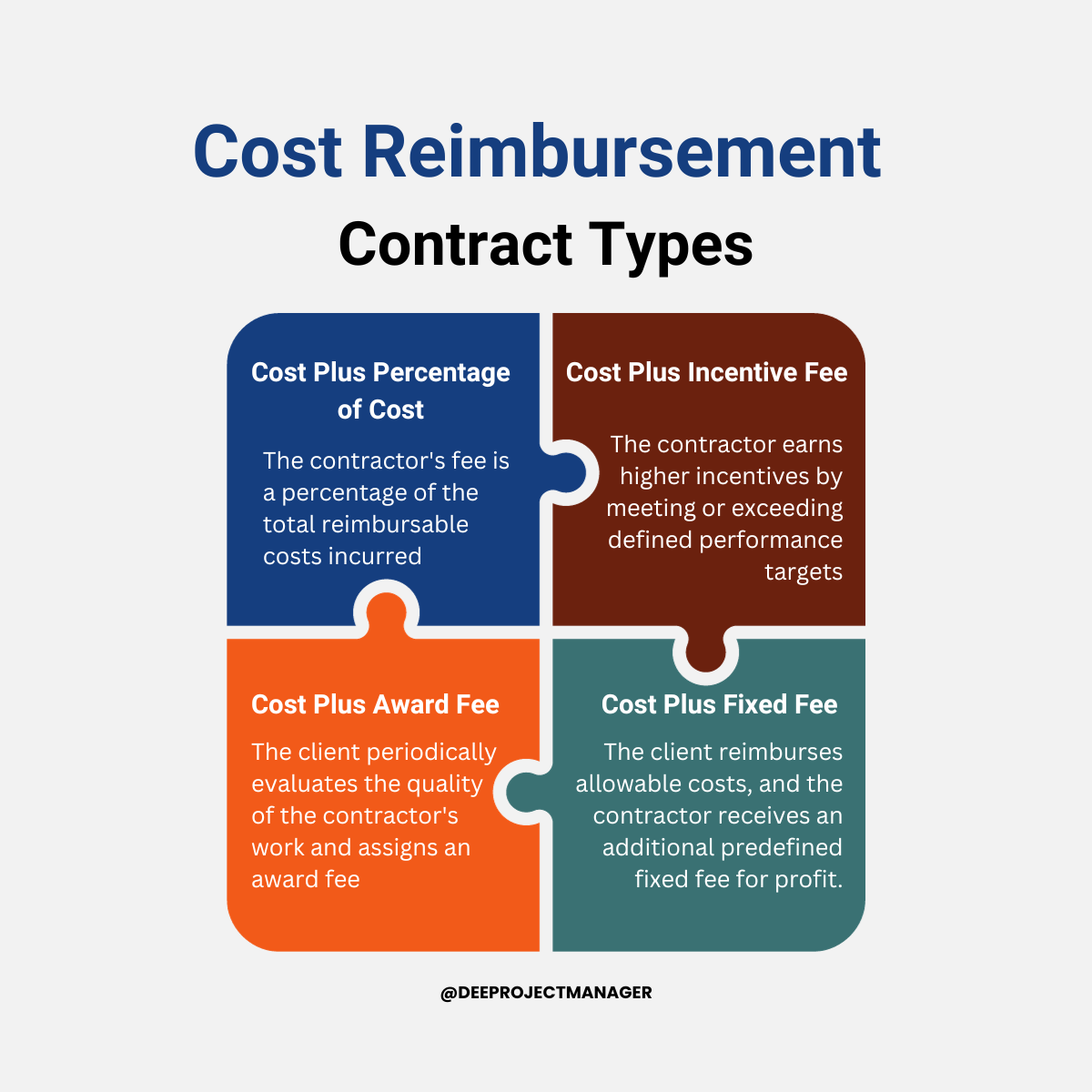

1. Cost-Plus-Fixed-Fee (CPFF)

This is the most basic form. The client reimburses allowable costs, and the contractor receives an additional predefined fixed fee for profit. The fee does not vary with actual costs incurred.

CPFF provides the contractor with a guaranteed profit margin while transferring maximum risk to the client and is well suited for initial research & development efforts with significant unknowns.

2. Cost-Plus-Incentive-Fee (CPIF)

Under CPIF, the contractor earns higher incentives by meeting or exceeding defined performance targets. These may relate to schedule, budget, quality, or other metrics.

The incentive fee adjusts up or down from a base amount based on how well the contractor performs versus the targets. This motivates the contractor to control costs and optimize performance.

A CPIF is appropriate when clear goals can be set to gauge contractor results.

3. Cost-Plus-Award-Fee (CPAF)

For a CPAF, the client periodically evaluates the quality of the contractor’s work and assigns a subjective award fee accordingly. This provides flexibility to assess performance against softer criteria that may be hard to quantify upfront.

The contractor does not know the exact fee amount during the project, only a possible range, providing motivation to maximize awards through superior work.

4. Cost-Plus-Percentage-of-Cost (CPPC)

In a CPPC contract, the contractor’s fee is defined as a specified percentage of the total reimbursable costs incurred.

For example, the contractor may receive a fee equal to 15% of total costs. As the reimbursed costs rise, so does the contractor’s profit fee.

This model aligns incentives for the contractor to maximize their costs within the terms of the contract. CPPC provides simplicity but can encourage cost escalations if not well managed.

Government contracts typically limit the maximum percentage that can be applied.

When to Use Cost Reimbursement Contracts

Cost reimbursement models make the most sense under certain conditions. Key situations where they are advantageous include:

- Requirements Are Unclear: If project requirements are ill-defined or likely to change, cost reimbursement allows flexibility to evolve the scope as needed without costly change orders.

- Outcomes Are Uncertain: For complex initiatives with too many uncertainties to accurately estimate a fixed price, cost reimbursement reduces contractor risk pricing.

- Trust Exists Between Parties: These contracts require significant trust between client and contractor since costs are open-book. Strong relationships help provide comfort.

- High-Risk Cutting Edge Work: For high-risk R&D type projects pushing state-of-the-art boundaries with no precedents to benchmark against, cost reimbursement pricing fits well.

- Resources Can Be Maximized: The model allows efficient staffing up when extra resources could accelerate progress versus a fixed budget constraint.

- Strong Project Controls Are In Place: Reimbursing costs requires diligent project financial monitoring and change control processes to detect issues early.

Advantages of Cost Reimbursement Contracts

Several notable benefits make cost reimbursement contracts appealing for certain types of projects.

These include:

- Shifts Risk from Contractor: With cost reimbursement, the financial risk lies primarily with the client rather than the contractor enabling more reasonable contractor bidding.

- Adaptable to Changing Requirements: Scope changes can be made without complex change orders given the flexible nature of the pricing model.

- Motivates Quality Work: Getting awarded higher fees based on performance motivates contractors to deliver superior quality and maximize value.

- No Incentive to Cut Corners: With an open book on costs, contractors don’t benefit from compromising on quality to reduce expenses.

- Maximizes Resources: Hiring additional expert staff becomes more feasible to accelerate progress when needed versus being constrained by a fixed budget.

- Simplifies Initial Bid: With less need to estimate total costs far in advance, the contractor bid can be fairly simple in many cases.

Disadvantages of Cost Reimbursement Contracts

While offering advantages in certain situations, cost reimbursement models also come with some potential drawbacks to consider:

- Client Assumes Cost Risks: The client takes on greater financial risk and responsibility for cost overruns under this model.

- Potential for Cost Escalation: Without a fixed price constraint, the potential exists for costs to escalate beyond expectations if not diligently managed.

- Requires Detailed Invoicing: The contractor must thoroughly document all reimbursable expenses and labor hours which increases administrative overhead.

- Less Cost Forecasting Visibility: It is harder for the client to predict total project costs, though the contractor may provide estimates.

- Need Strong Client Monitoring: Close project oversight is imperative to ensure the contractor bills properly for allowable costs and avoids excessive charges.

- Less Contractor Incentive to Control Costs: The model provides fewer direct incentives for contractors to operate efficiently and minimize expenses.

Cost Reimbursement Contract Example

Let’s look at a scenario where you engage an engineering firm to design and prototype a new product to illustrate how a cost reimbursement contract might work.

The product is highly complex with a lot of technical unknowns and uncertainties about the best approach, hence a fixed price contract would require pricing in too many contingencies given all the project risks.

Consequently, you mutually agree to use a Cost-Plus-Incentive-Fee (CPIF) contract to provide flexibility while motivating strong contractor performance. The contract terms include:

- All approved direct labor, equipment, materials, subcontractor, and travel costs will be reimbursed by you as the client.

- Labor rates are attached for various contractor team member roles and levels.

- The target fee is 8% of total costs, structured with a 2% base fee and a 6% maximum incentive amount.

- To earn the incentive, the contractor must meet targets for schedule, cost control, and prototype performance.

The contractor proceeds with design working closely with your team. They provide monthly cost reports and invoices detailing hours, expenses, and fees earned based on their progress against the incentive metrics.

The open communication and risk sharing under the CPIF contract helped facilitate an agile collaboration.

Despite some emerging design changes, the contractor was able to deliver an innovative prototype within the expected cost range to earn their full incentive fees.

Cost Reimbursement vs Time and Materials

Cost reimbursement contracts and time and materials (T&M) models share some similarities but also have important differences to consider:

Cost Visibility

Both provide open book cost tracking – the client can review expenses incurred. But T&M offers better foreseeability by tying labor to hourly rates versus cost reimbursement where expenses can vary more widely.

Contractor Profit

In T&M the markup on hourly rates provides the contractor’s profit. Cost reimbursement relies on a negotiated fee for margin.

Change Management

Scope changes can be handled flexibly in either model without change orders. On the other hand, T&M may require rate adjustments if the work differs significantly from initial expectations.

Client Oversight

Diligent client monitoring is critical in both cases, but potentially more intensive under cost reimbursement if contract terms are not tightly defined.

Risk Allocation

The client takes on more risk of cost overruns under cost reimbursement. The contractor assumes more risk in T&M if hours exceed estimates.

Project Type Suitability

T&M offers advantages for smaller, well-defined efforts. Cost reimbursement better accommodates large, complex projects with many unknowns.

Cost Reimbursement vs Fixed Price

Cost reimbursement contracts differ significantly from fixed price models in several key ways:

Cost Risk

With fixed price, the contractor owns any cost overruns unless the client approves changes. Whereas cost reimbursement contract transfers overrun risk to the client.

Price Basis

Fixed price contracts are bid based on the contractor’s cost estimates. While cost reimbursement pricing relies on actual costs incurred.

Scope Flexibility

Scope changes under fixed pricing often require negotiated change orders. But cost reimbursement provides flexibility to evolve requirements without contract amendments.

Cost Predictability

Fixed price enables the client to lock in total costs upfront while cost reimbursement has less certainty on total spend until project completion.

Profit Margin

In fixed pricing the contractor’s profit is built into the total price bid. On the other hand, under cost reimbursement it is handled separately via an agreed upon fee percentage.

Best Suited Projects

Fixed pricing models work best for well-defined, low-risk efforts. While cost reimbursement accommodates complex projects with too many uncertainties for accurate fixed pricing.

Conclusion

When chosen for the right situations, cost reimbursement contracts can provide an effective way to maximize project success under uncertainty.

The key is assessing whether the flexibility and risk transfer benefits outweigh the potential drawbacks of cost monitoring and reduced price certainty.

Perform due diligence in evaluating the project characteristics and comparing alternatives like fixed price or T&M approaches.

Also, make sure to partner with a trusted, experienced contractor who can provide transparency in the reimbursement process.

With careful execution, cost reimbursement models offer a viable pricing mechanism for complex, high-risk initiatives where requirements are likely to evolve over the project lifecycle.

FAQs

Who Typically has more Risk in a Cost Reimbursable Contract?

In a cost reimbursable contract, the client typically assumes more financial risk compared to the contractor.

The client agrees to reimburse the contractor’s allowed expenses regardless of any cost overruns or budget issues, unless negligence is proven. The contractor’s risk is lower since their costs are covered.

Is Time and Materials a Cost Reimbursement Contract?

T&M contracts are not a full form of cost reimbursement since the contractor assumes risk if hours exceed the estimate.

However, T&M agreements share similarities in that the client reimburses approved contractor expenses and labor hours billed at negotiated rates that include profit margin.

What is Reimbursement Cost?

Reimbursement cost refers to expenses incurred by a contractor during the execution of work that are allowable to be billed back to the client under the terms of a cost reimbursable contract.

The client repays these costs to the contractor, typically with verification of the expenses through invoices and progress documentation.